CalvenRidge Trust Review (2026)

AI-Assisted Wealth Management for Canadian Investors: Features, Safety, Fees & Real-World Usability

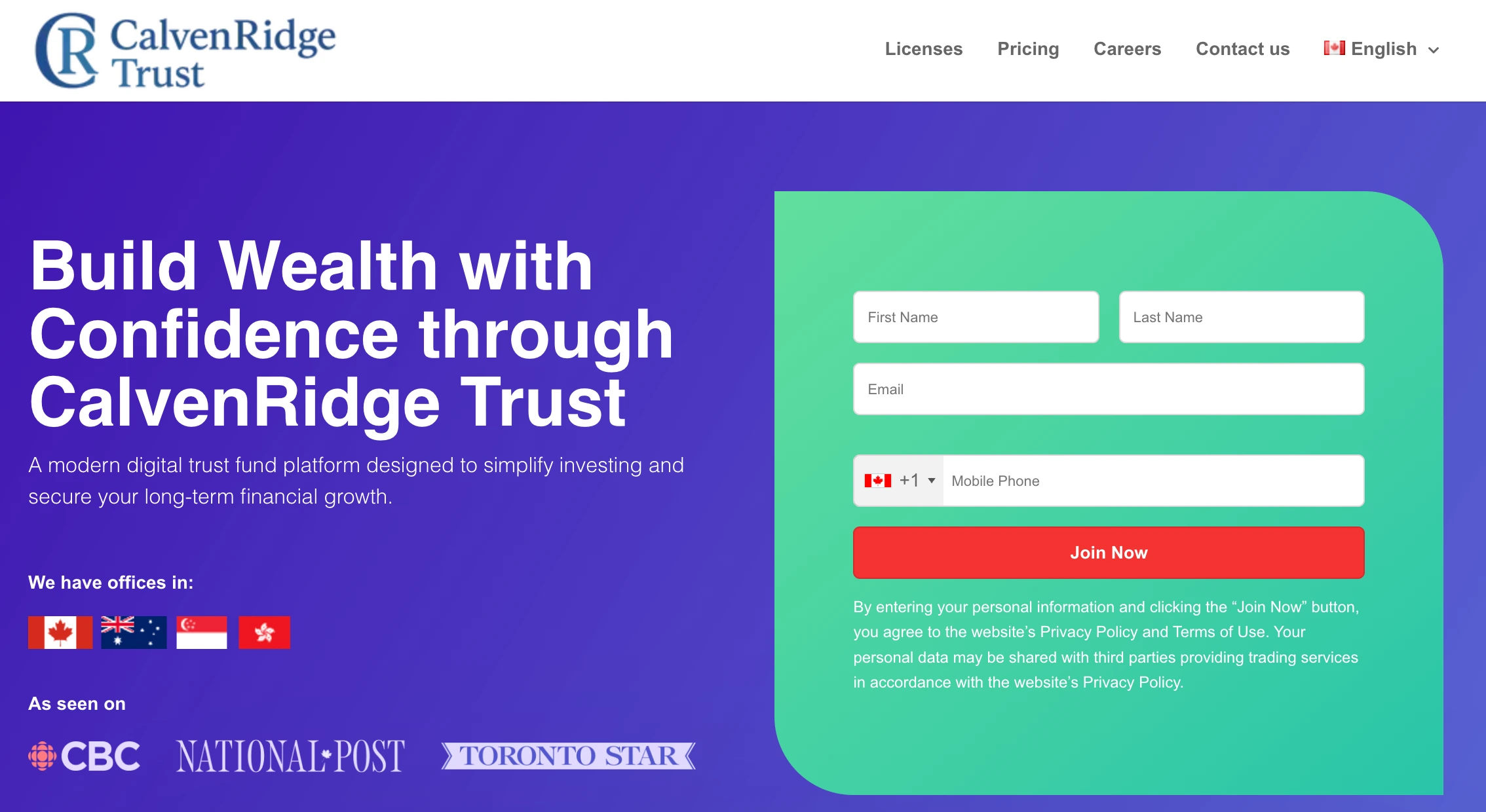

Join CalvenRidge Trust NowIn today’s fast-moving finance environment, platforms that blend automation, risk controls, and clear onboarding are in demand. This CalvenRidge Trust review explains what it is, how it works, what Canadians should know (fees, withdrawals, safety), and what to expect from an AI-assisted investment experience.

What is CalvenRidge Trust?

CalvenRidge Trust presents itself as an AI-assisted wealth management platform designed to make multi-asset investing simpler. Instead of requiring full-time chart watching, it leans on automation and structured risk controls, with an optional advisor-led setup to align strategy with your goals.

In practical terms, it’s positioned as a “guided investing” solution for users who want exposure beyond traditional savings products—while still keeping usability and reporting central.

Platform pillars (at a glance)

- Security-first posture: encryption, access controls, and platform safeguards.

- Automation: AI-assisted execution and monitoring across supported markets.

- Accessibility: strategy setup guidance + dashboards for non-technical users.

How CalvenRidge Trust works (step-by-step)

- Create an account and complete basic verification.

- Define goals and risk tolerance (often via an onboarding call or guided questionnaire).

- Fund your account (minimum deposit typically starts around CA$250).

- Strategy activation: automation and risk settings are applied based on your chosen profile.

- Monitor and adjust: review reports and refine risk preferences over time.

Features & platform capabilities

| Feature | Why it matters |

|---|---|

| AI-assisted automation | Continuous monitoring and execution support—useful if you can’t track markets daily. |

| Multi-asset exposure | Diversification across markets can reduce reliance on a single asset class. |

| Risk controls | Position sizing and protective logic helps limit emotional decisions during volatility. |

| Advisor-guided onboarding | Helpful for beginners who want a structured setup rather than trial-and-error. |

| Reporting & dashboards | Performance summaries and visibility into portfolio behavior—important for trust and clarity. |

Fees, minimum deposit & withdrawals

Minimum deposit: commonly promoted around CA$250 (may vary by partner/broker).

Fees: can depend on the connected broker, account type, and service structure (ask support for a breakdown).

Withdrawals: processing speed depends on verification status and payment rails; always confirm timeline before depositing.

Testing notes (what to expect in real use)

To evaluate usability, I focused on onboarding clarity, dashboard reporting, and how risk settings are explained. As with any automated system, results can vary widely depending on market conditions and configuration—so the most important part is risk control + transparency.

Safety: Is CalvenRidge Trust legit?

When evaluating legitimacy, focus on transparency, clear terms, withdrawal policies, and how the platform is actually structured (e.g., broker integration). Avoid relying only on marketing claims.

- Clear fee disclosure and onboarding documentation

- Security features (2FA, encryption, access controls)

- Transparent withdrawal process and timelines

- Responsive support with trackable communication

- Guaranteed profits or unrealistic fixed daily returns

- Pressure tactics (“limited spots” used aggressively)

- Hidden fees or unclear withdrawal conditions

- No documentation about how trades are executed

Canada focus: what Canadian investors should know

Tip: Ask support for a written fee/withdrawal summary before funding. It’s the fastest way to avoid surprises.

Pros & cons

- Guided onboarding (helpful for beginners)

- Automation + risk controls for hands-off users

- Multi-asset diversification approach

- Dashboard-based monitoring and reporting

- Fees/terms can vary by partner (must verify)

- No universal “best” strategy—risk settings matter

- Automation can’t remove market risk

- Users should validate withdrawal policy before depositing

Frequently Asked Questions

Safety depends on security controls (2FA, encryption), transparent terms, and the platform’s withdrawal process. Always verify the broker/partner details and read fee + withdrawal conditions before funding.

The commonly advertised minimum deposit starts around CA$250, but it may vary by broker, promotion, or payment method.

Withdrawals usually require identity verification and may be processed through the same payment rails used for deposits. Processing time can vary—ask support for the expected timeline and any fees before you deposit.

It can be, especially if onboarding is advisor-guided and risk settings are explained clearly. Beginners should start small, learn the reporting, and avoid high-risk profiles until they understand drawdowns.

No. AI can assist with monitoring and execution, but market risk remains. Any platform promising guaranteed returns should be treated cautiously.

Verdict: Strong option if you value guidance + risk discipline

CalvenRidge Trust is best suited to Canadians who want a structured onboarding experience, multi-asset exposure, and clear reporting—without needing to actively trade every day.

Join CalvenRidge Trust NowTip: Start with the minimum deposit and confirm fees/withdrawal terms in writing before scaling up.

Disclaimer: This page is for informational purposes and does not constitute financial advice. Investing involves risk, including potential loss of capital. Past performance does not guarantee future results. Always do your own research and consider your financial situation before investing.