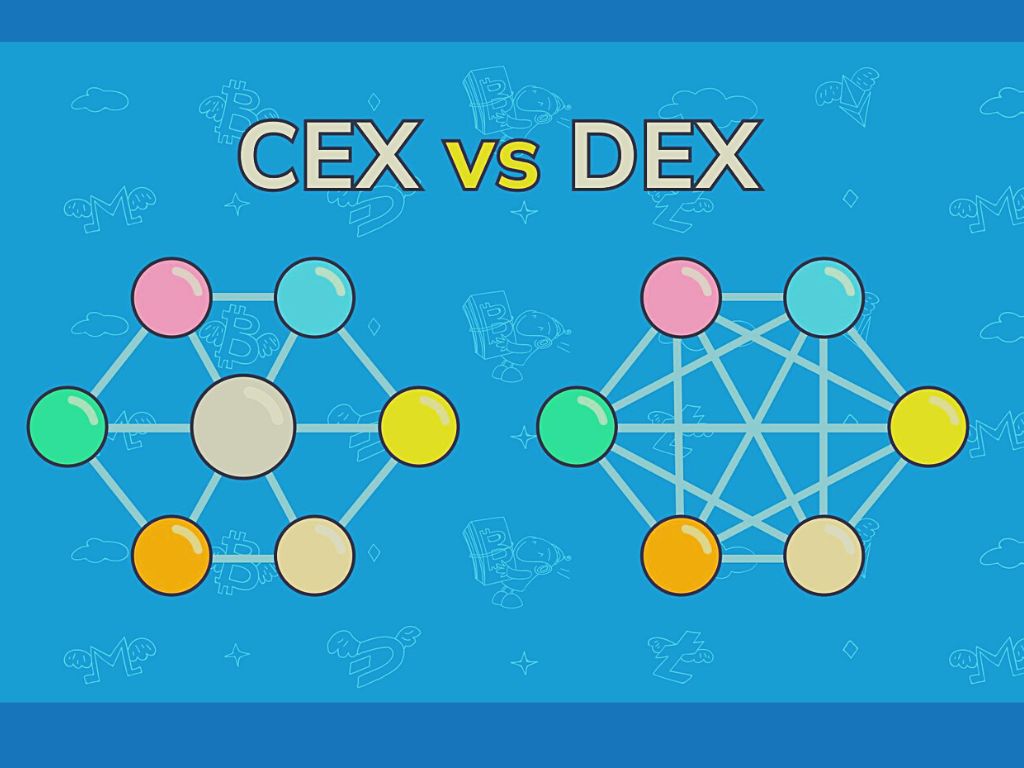

When it comes to trading cryptocurrencies, the type of exchange you choose can have a significant impact on your overall experience. Two of the most popular types of exchanges are centralized and decentralized exchanges. In this article, we will explore the differences between these two types of exchanges and the pros and cons of each. The goal of this article is to inform readers of the key differences between centralized and decentralized exchanges, and help them make an informed decision on which type of exchange best suits their needs.

Centralized Exchanges

A centralized exchange, or CEX, is a type of cryptocurrency exchange that is operated by a central authority. This central authority holds the assets of its users and manages the trading process. Some examples of centralized exchanges include Binance, Coinbase, and Kraken.

Centralized exchanges are known for their user-friendly interface and high liquidity. This means that it is easy for users to navigate the platform and find the coins they want to trade. Additionally, the high liquidity of centralized exchanges means that it is easy to buy and sell large amounts of cryptocurrency quickly.

However, centralized exchanges also have their downsides. One of the main cons is that they are a single point of failure. This means that if the central authority running the exchange is hacked or goes out of business, users may lose their assets. Additionally, centralized exchanges are vulnerable to hacking and other types of cyberattacks. Finally, users must trust the central authority to securely hold and manage their assets. For more details on DEXs and a list of decentralized exchanges, you can visit.

Decentralized Exchanges

A decentralized exchange, or DEX, is a type of cryptocurrency exchange that is run on a blockchain. This means that it is not operated by a central authority and instead relies on smart contracts to facilitate trades. Some examples of decentralized exchanges include Uniswap and Kyber Network.

Decentralized exchanges offer a greater level of security than centralized exchanges. Since there is no central authority, there is no single point of failure. Additionally, decentralized exchanges are censorship-resistant, meaning that no single entity can control or block trades. Finally, users do not need to trust a central authority to hold and manage their assets.

However, decentralized exchanges also have their downsides. One of the main cons is that they have lower liquidity compared to centralized exchanges. This means that it can be harder to buy and sell large amounts of cryptocurrency quickly. Additionally, decentralized exchanges typically have a less user-friendly interface, which can make it harder for new users to navigate. Finally, transaction speeds on decentralized exchanges may be slower than on centralized exchanges.

Comparison of Centralized vs Decentralized Exchanges

When it comes to trading cryptocurrencies, both centralized and decentralized exchanges have their own set of pros and cons. Centralized exchanges are known for their user-friendly interface and high liquidity, while decentralized exchanges offer greater security and censorship-resistance.

However, there is a trade-off between security, convenience, and speed. If you prioritize security and independence from central authorities, a decentralized exchange may be the best choice for you. However, if you prioritize convenience and fast trading speeds, a centralized exchange may be a better fit.

Ultimately, the choice between centralized and decentralized exchanges will depend on your individual needs and preferences as a trader. It’s important for users to research and make their own decision.

Conclusion

In conclusion, centralized and decentralized exchanges are two popular options for trading cryptocurrencies. Centralized exchanges offer a user-friendly interface and high liquidity, while decentralized exchanges offer greater security and censorship-resistance. It’s important for users to research and make their own decision on which type of exchange best suits their needs. Ultimately, the choice between centralized and decentralized exchanges will depend on your individual needs and preferences as a

lized exchanges will depend on your individual priorities and preferences as a trader.

It’s also worth noting that some projects and platforms are working on hybrid solutions that combine the best features of both centralized and decentralized exchanges, such as the World’s First Cooperative Decentralized Exchange mentioned in the title of the article, which aims to overhaul traditional cryptocurrency exchange reward programs.

In any case, both centralized and decentralized exchanges have their own unique set of advantages and disadvantages, and it’s important to weigh them carefully before making a decision. It’s also important to keep in mind that the cryptocurrency space is constantly evolving, and new developments and solutions are emerging all the time.

In summary, it’s crucial to stay informed and up-to-date on the latest developments in the cryptocurrency space, and to choose an exchange that aligns with your individual needs and priorities. By understanding the key differences between centralized and decentralized exchanges, you will be better equipped to make an informed decision and have a more successful trading experience.